Is your UK workplace pension plan working for you and your employees?

Could you be doing more for your workplace pension scheme, to cut costs and build employee engagement? Too good to be true?

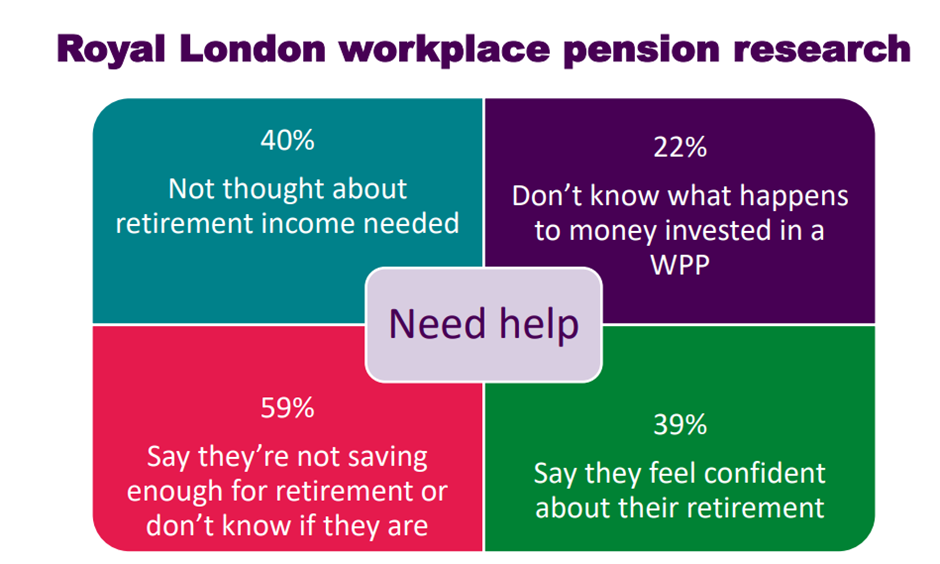

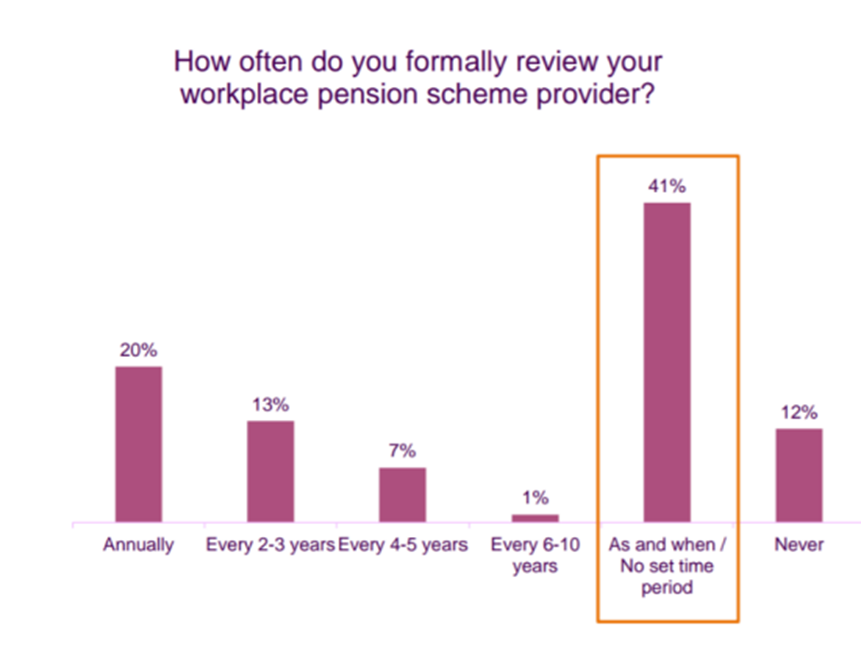

Executive summary: It is now over 10 years since the UK government introduced mandatory pension auto-enrolment for all employees who are between 22 and the State Pension Age, earn more than £10k a year and work in the UK. Many employers, fearful of the consequences of not complying with new government laws, rushed into setting up pension schemes fearful of potential penalties of up to £50,000 per company. Since auto-enrolment, many companies have not reviewed legacy workplace pension plans which can offer poor value for money and contribute to lower employee engagement. The top three HR priorities right now for employers are: employee engagement, attracting talent and retaining talent. Recent workplace pension research shows that over 59% of employees say that they’re not saving enough for retirement or don’t know if they are. With companies facing inflationary cost increases, particularly in wage inflation, responsible companies should review their pension arrangements that not only provide cost savings for the company but also better options and outcomes for their employees. A recent survey indicated that 63% of companies do not review their workplace pension on a set timetable or have never reviewed it. To demonstrate the potential savings a company with 50 scheme members and assets of £1.4 million could potentially save £12,930 annually. These savings could go directly to the company or could be used to enhance employee benefits which increase employee loyalty and can offset salary increases. A potential win-win for employers and employees.

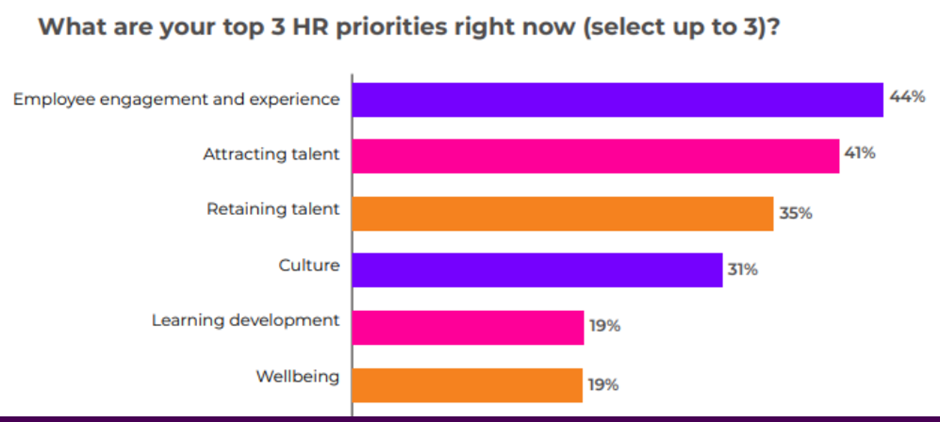

What are the Employers current top 3 priorities right now?

Recent research indicated the following priorities for Employers:

Source: Workbuzz – The state of employee engagement 2022 – October 2022

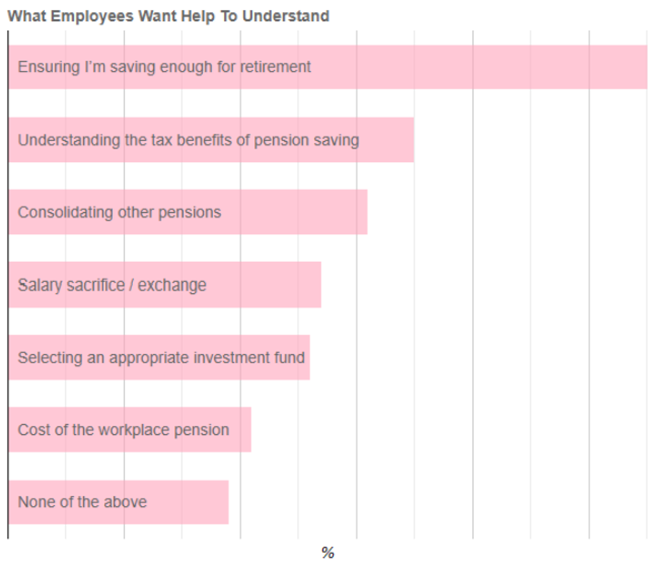

What do Employees want?

Source: The 2022 Drewberry workplace pension survey

What are employee concerns?

Source: Royal London Workplace pension survey – August 2023

As an employer how often do you formally review your workplace pension provider?

Source: Royal London Employer Relationship Study, Dec 2021

The good, the bad and the boring

The boring

Pension funds are structured into two types of entities:

- Master Trust – A Master Trust is usually operated by a group of Trustees and regulated by The Pensions Regulator. Employee contributions into this type of scheme are usually net pay (contribution is after tax). Ten years ago, most pension schemes established were Master Trust schemes and offered limited employee and employer flexibility. Whilst Master Trusts offer benefits for higher rate relief at source which is a benefit to higher earning employees lower earners are impacted given that contributions are net of pay (lower take-home pay).

- Contract-based schemes are overseen by Independent Governance Committees and governed by the FCA. Typically, these plans offer relief at source (salary sacrifice) and are much more flexible.

The bad

A vast number of employers have selected Nest, the government-owned pension provider. Nest has ranked at the bottom of provider service ratings in two recent surveys.

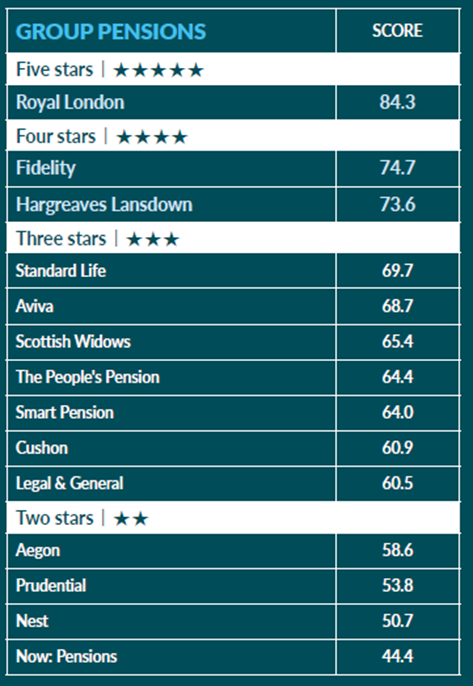

Corporate Advisor Intelligence Provider Service Ratings

Source: Corporate Adviser Intelligence, Provider Service Ratings 2023

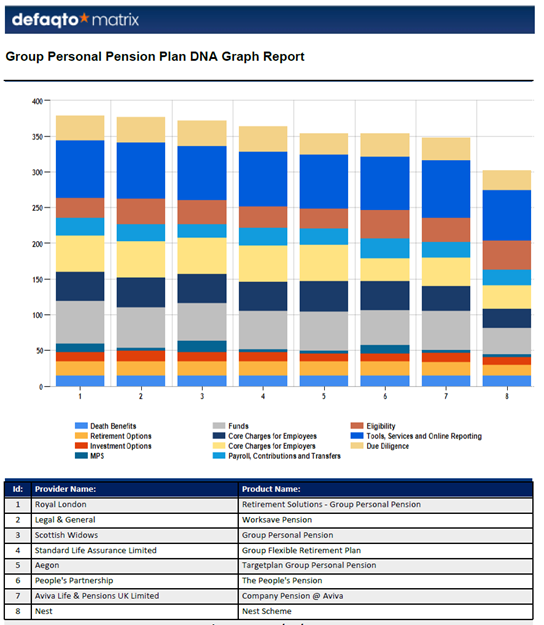

Defaqto Service Rankings Group Personal Pensions

Source: Defaqto DNA Graph 02/10/2023

The good

Employers and employees could benefit by using salary exchange.

What is salary exchange?

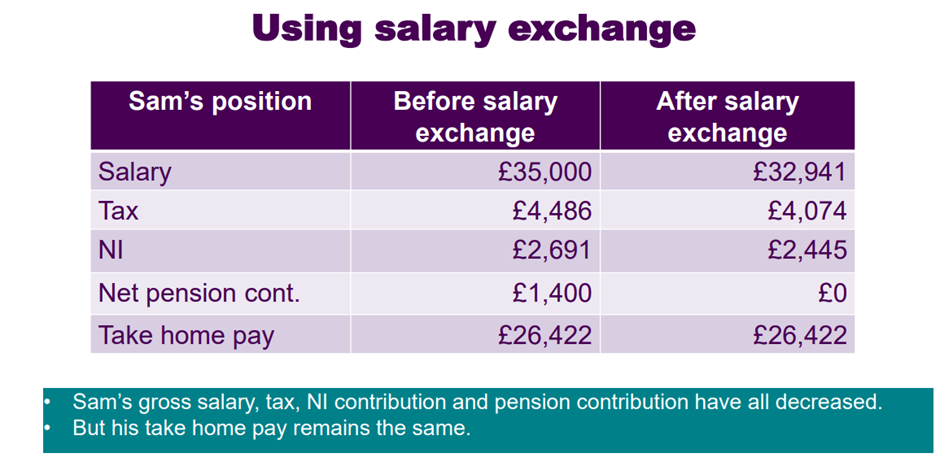

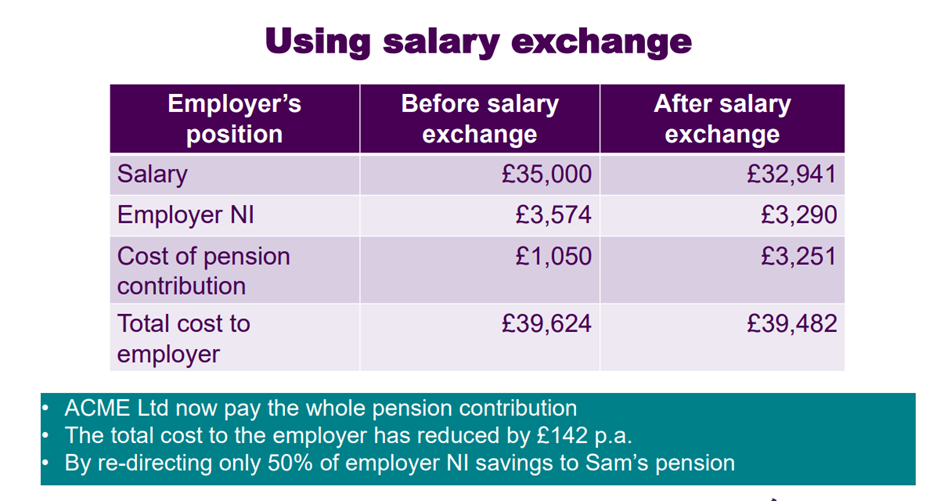

Salary exchange is an agreement between the employee and employer to exchange part of your gross salary for a pension contribution. Utilising this method can offer savings for both the employee and employer. Let’s use a hypothetical example of Sam who works for Acme Inc.

Using salary sacrifice from Sam’s perspective:

Using salary sacrifice from the employer perspective:

What are the potential savings?

Sam is saving an extra £451 per year for same take home pay.

Acme saves £142 annually for each year per employee. For a 50-person scheme this equates to £7,100 per year.

In another example to demonstrate employer savings take a hypothetical scheme for Beta Company:

- 50 scheme members

- Average employee salary of £34,000

- 3% employer and 5% employee pension contributions

- Set up in 2010 prior to auto enrolment.

- Includes a yearly fee of £1,200 which had not been reviewed since set up.

- Annual management charge of 0.75%

- Total assets of £1.4 million

- Scheme members only interaction with the pension provider was a yearly statement.

Upon a review of the scheme Beta Company introduced the following changes which saved the company £12,930:

- Removed yearly employer fee of £1,200.

- Reduced annual management charge from 0.75% to 0.47%

- Switched their plan to a mutual where scheme members could be eligible for a Profitshare contribution to their scheme assets.

- Established salary sacrifice plan which saved the employer £11,730 in National Insurance charges.

- Introduced annual scheme reviews.

- New workplace pension provider introduced compliance reviews to prevent fines.

- Introduced employee financial wellbeing clinics to increase employee engagement and provide better long-term employee outcomes.

- Used pension savings to provide employee life insurance to increase employee loyalty and engagement.

Conclusion

A review of your current workplace pension scheme could offer an increase in benefits and offer better long-term outcomes for your employees, reduce employer cost and improving employee loyalty.

What are the next steps?

To provide a free analysis or your workplace pension plan please contact Corey Cook, CFA Ch.FCSI on 07738 843 740 or corey.cook@octofp.com

Author: Corey Cook, CFA Ch. FCSI

Peer reviewed: Stephen James, Chartered Financial Planner

Octo Financial Planning Ltd is an appointed representative of 2plan wealth management Ltd which is authorised and regulated by the Financial Conduct Authority. Ltd Company name is entered on the FCA register (www.FCA.org.uk) under no. 972331. The information contained with this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK. Registered office: Sackfords, Mole Hill Green, Felsted, Dunmow, CM6 3JP. Registered in England and Wales Number: 13922409.